how are property taxes calculated at closing in florida

To calculate the seller closing costs lets take Happy Home Seller for example. Florida sellers should expect to pay closing costs between 62590 of the homes final selling price including real estate agent commissions.

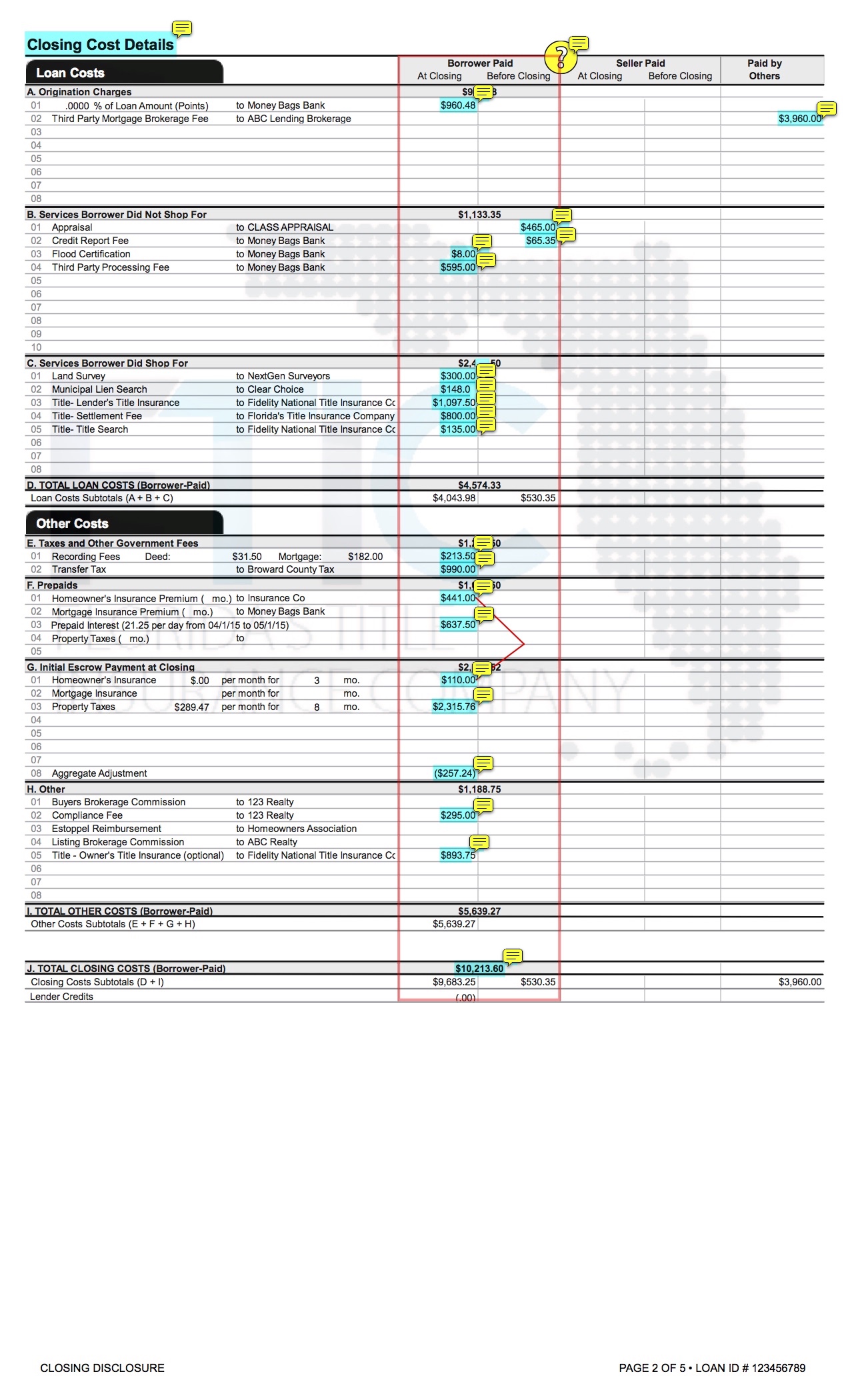

A Guide To Understanding Your Closing Disclosure Better Better Mortgage

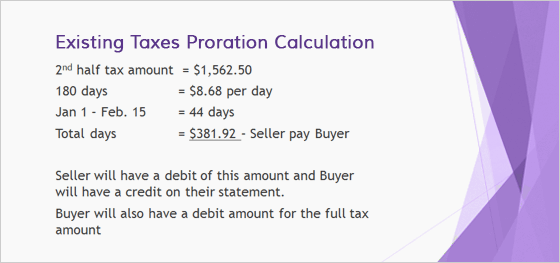

This is an easy formula that you can use to quickly get the prorated property tax that you can advise to your.

. Proportion Calculation - X sellers of days total amount tax 365 days. In the state of Florida property taxes are sent at the end of a calendar year and are paid in arrears ie one year behind the current year. 4200 12 350 per month.

In Florida transfer taxes are also referred to as documentary stamps or doc stamps and theyre typically paid by the seller. While observing constitutional limitations prescribed by statute the city creates tax rates. Florida uses a bracket system for collecting sales tax on any taxable sale that is less than a whole dollar amount.

Figuring out the amount of your doc stamps. Generally at closing the Seller pays property taxes dating from January 1 of that year until the date of closing. Instead the seller will typically pay between 5 to 10 of the sales price and the.

Happy Home Seller sells his house to Buyer Brenda in January. How are property taxes handled at a closing in florida. This proration accounts for the time that the Seller still owned the.

All legal Florida residents are eligible for a Homestead. Heres how to calculate property taxes for the seller and buyer at closing. Plus the state is still ranked as the 23rd in the nation in terms of the average amount of property taxes collected.

As will be covered further appraising property billing and collecting payments conducting. Enter your Home Price and Down Payment in the fields. This will give you the money that you owe in property taxes.

In florida you should expect to pay around. In calculating the sales tax multiply the whole dollar. With respect to how property taxes are handled and paid at the closing in Florida effectively the property taxes are paid by the seller through the date of the closing in.

Based on the median home value. Use this Florida Mortgage Closing Cost Calculator to estimate your monthly mortgage payment including taxes insurance and PMI. Take your property tax rate and multiply it by the value of the property.

Divide the total annual amount due by 12 months to get a monthly amount due. The average property tax in Florida is an annual 173300. The closing date is scheduled.

Closing Costs In Florida What Sellers Need To Know

Florida Seller Closing Cost Calculator 2022 Data

Closing Costs Calculations Practice Video Lesson Transcript Study Com

Buying A House Who Pays Closing Costs In Florida

How To Calculate An Escrow Payment 10 Steps With Pictures

How Are Property Taxes Handled At A Closing In Florida

Florida Real Estate Taxes Echo Fine Properties

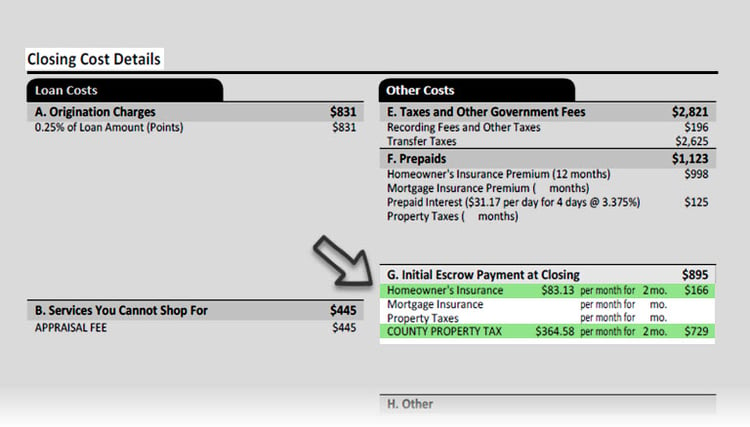

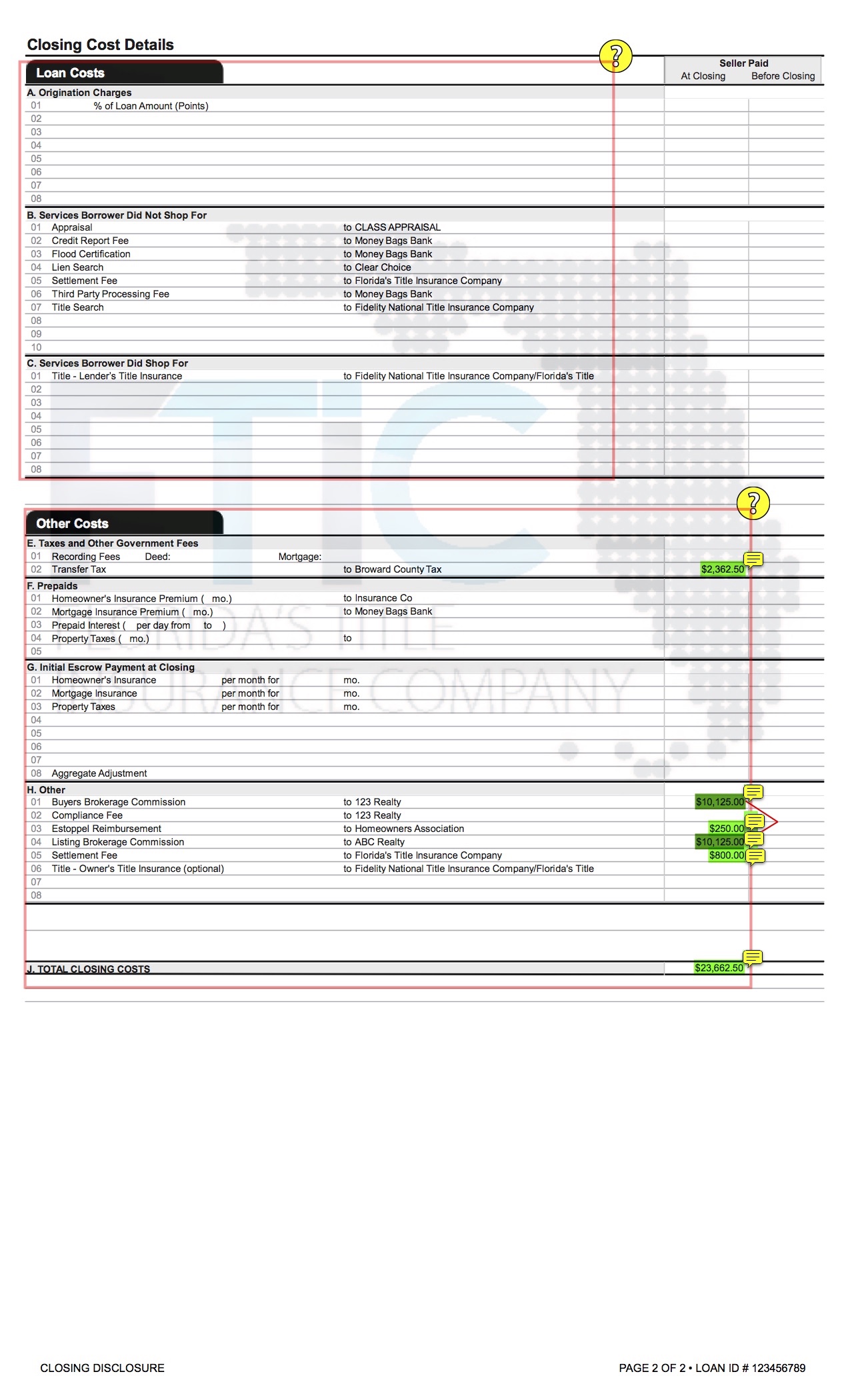

How To Read Seller S Closing Disclosure I E Seller S Closing Costs Florida S Title Insurance Company

Complete Guide To 2021 Closing Costs In Florida Newhomesource

How To Comply With The Closing Disclosure S Three Day Rule Alta Blog

Real Property Transfer Taxes In Florida Asr Law Firm

California Property Taxes Viva Escrow 626 584 9999

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

The Property Tax Annual Cycle In Washington State Myticor

How To Read A Buyer S Closing Disclosure Florida S Title Insurance Company

Your Real Property Tax Bill When Selling Or Buying Real Estate Real Estate Law Blog

Closing Costs In Florida The Complete Guide

Adjustments And Prorations Of Taxes For Closing In Florida Usa